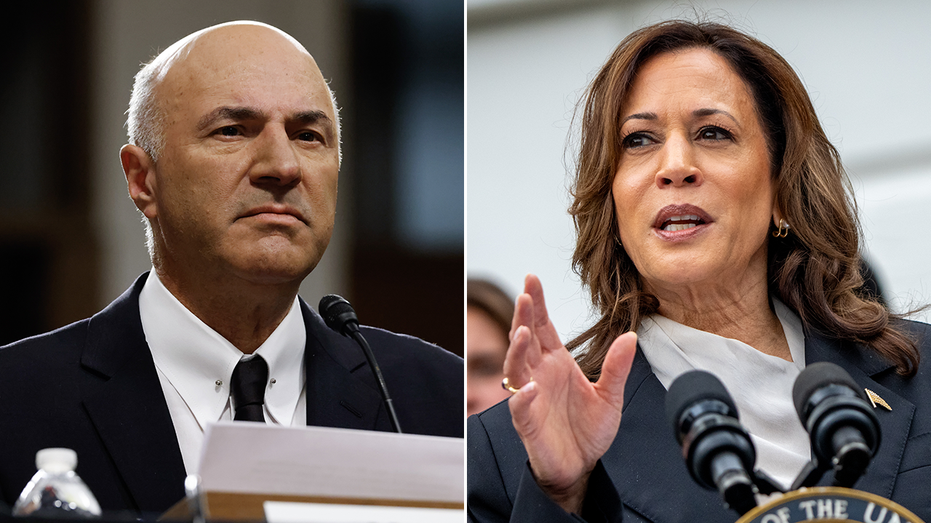

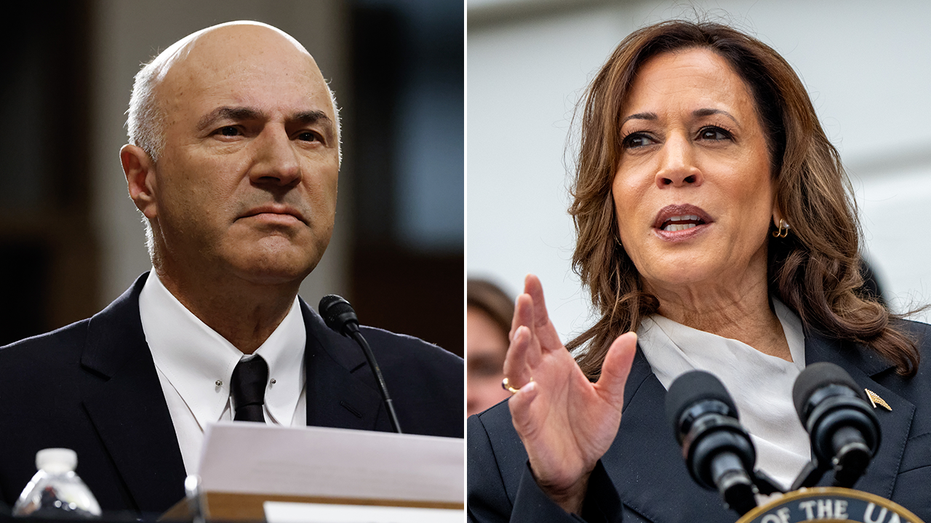

O’Leary Ventures Chairman Kevin O’Leary discusses Kamala Harris’ proposed tax policies on ‘The Big Money Show.’

Vice President Kamala Harris’ tax policies could cripple the U.S. economy – especially when it comes to capital growth and upholding the coveted American dream, according to “Shark Tank” star Kevin O’Leary.

The O’Leary Ventures chairman schooled the Democratic presidential nominee and warned of the “multiple effects” these policies would have, not only for business, but for Americans on a personal level.

“Taxes will go up with their proposals,” he said on FOX Business’ “The Big Money Show” Thursday, also adding “she’s admitting that, she’s not denying it.”

“That’s a debate that’s going on in terms of the classic, ‘make the rich pay their fair share,’” he continued. “That’s a narrative that goes into every single election cycle.”

O’LEARY SOUNDS OFF ON HARRIS’ ‘INSANE,’ ‘UN-AMERICAN’ PROPOSALS AHEAD OF ANTICIPATED CNN INTERVIEW

While Trump and Harris have both highlighted new tax provisions in their 2024 plans, Harris’ campaign website listed policies that include: quadrupling the tax on stock buybacks; imposing a 25% “minimum” tax on wealthy households; and increasing taxes on capital gains and dividends for households making more than $1 million from 20% to 28%.

Kevin O’Leary stressed over the implications of Vice President Harris’ corporate tax policy on FOX Business Thursday. ((Photo by Andrew Harnik/Getty Images) / Photographer: Ting Shen/Bloomberg via Getty Images / Getty Images)

However, O’Leary, also known as “Mr. Wonderful,” stressed over the implications of Harris setting the corporate tax rate at 28%.

“The more concerning one for the economy, not just personal taxes, is corporate tax rates. That, at her proposed 28%, would put the U.S. economy in an uncompetitive position.”

O’Leary continued pointing out that higher corporate tax rates would potentially drive business and investment out of America.

“Last time we did this to ourselves, we started to see dislocation of headquarters moving to places like Ireland and other lower tax jurisdictions,” he explained. “That, we shouldn’t do. That’s a mistake for either party. That’s a huge mistake.”

O’Leary Ventures Chairman Kevin O’Leary on Vice President Kamala Harris’ plan to implement price controls if elected and warnings against former President Trump’s push for tariffs.

Using the G7 and G20 meetings, where global leaders meet regularly to discuss top geopolitical issues, as examples, O’Leary further clarified his position.

“We’re right in the middle, right now, in the G7, G20. So if all of a sudden we start charging [a] 28% corporate tax rate, plus add on state [taxes], in some cases, you’re in the 30 [percentile] and that’s just not competitive anymore in terms of the G20 or G7.”

“That’s, to me, the most horrific outcome, and I’m very nervous about that,” O’Leary said.

Nonetheless, despite who is elected to the White House come November, O’Leary claimed policy “uncertainty” is a major concern.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Heritage Foundation economist Steve Moore explains the difference between Ronald Reagan’s tax cuts and Kamala Harris’ plan to raise taxes on ‘Making Money.’

“This [is] a policy-lite election. I’m disappointed that Harris doesn’t give us more policy specifically on taxes, specifically on corporate taxes. I need to know that. So does everybody else,” he said, also emphasizing that higher corporate taxes create fewer opportunities to create capital.

“Remember, this is the No. 1 economy on Earth… 50% of capital invested worldwide comes here. We don’t want to do anything to change that,” he said.

READ MORE FROM FOX BUSINESS

FOX Business’ Breck Dumas contributed to this report.