Galaxy Digital CEO Michael Novogratz discusses the presidential candidates’ takes on cryptocurrency after it was not mentioned during the Trump-Harris debate on ‘The Claman Countdown.’

Exclusive: House Majority Whip Tom Emmer and Rep. Patrick McHenry are seeking clarity on the Securities and Exchange Commission’s regulatory approach to a method of distributing crypto tokens known as “airdropping,” FOX Business has learned.

In a letter sent Tuesday to SEC Chair Gary Gensler and viewed by FOX Business, Emmer, R-Minn., and McHenry, R-N.C., raise concerns that the proclaimed cop on the crypto beat is engaging in a regulatory power grab by classifying certain “airdrops” as unregistered securities.

“Under Chairman Gensler’s tenure, the SEC has put its thumb on the scale and prevented Americans from shaping the next iteration of the internet,” Emmer said in a statement to FOX Business. “Airdrops play an important role in incentivizing participation in blockchain-based applications, which, in turn, contribute to the continued development, initial governance, and ultimate decentralization of these networks.”

COINBASE SUES SEC, FDIC FOR INFORMATION RELATING TO CRYPTO REGULATION

SEC Chairman Gary Gensler participates in a meeting of the Financial Stability Oversight Council at the U.S. Treasury on July 28, 2023, in Washington, D.C. (Kevin Dietsch / Getty Images)

Airdropping is when a blockchain project developer sends free tokens directly to a crypto wallet to attract users to a platform, which industry supporters liken to loyalty rewards such as airline miles or credit card points. While the SEC has not brought an enforcement case specifically targeting airdrops, it has raised the possibility in recent enforcement actions against crypto firms that, in certain circumstances, crypto airdrops may qualify as securities.

Gensler has stated in congressional testimony his belief that most cryptocurrency tokens, except for bitcoin and ethereum, are unregistered securities trading illegally. Under his leadership, the agency has embarked on a three-year regulatory blitz against the $2 trillion digital asset industry. Critics of the SEC’s enforcement approach say the agency is being overly broad with its interpretation of the Howey test – the agency’s litmus test for determining whether assets are securities.

GRAYSCALE TO LAUNCH FIRST US XRP TRUST, PAVING WAY FOR POTENTIAL ETF

Emmer and McHenry’s letter demands answers to five questions, including how the SEC distinguishes between rewards like airline miles and airdropped crypto tokens, as well as how the agency believes the Howey test applies to free crypto tokens being given to users.

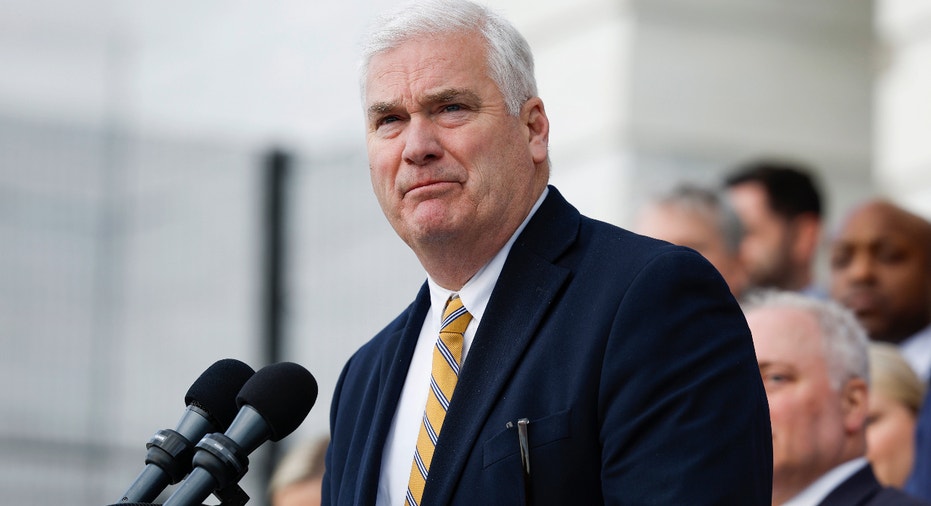

House Majority Whip Tom Emmer, R-Minn., speaks at an event celebrating 100 days of House Republican rule at the Capitol on April 17, 2023. | Getty Images

“We are concerned that a misapplication of the securities laws will prevent this technology from achieving decentralization and its full potential,” the lawmakers wrote.

Many blockchain developers use airdrops as a promotional tool to entice new users to their platforms or as a reward for early adopters of a new project. Token holders can use their tokens for governance rights, to interact or complete tasks on the platform, or to claim a stake in the future growth of the platform.

Recent enforcement actions have indicated that certain types of airdrops could meet the criteria for an investment contract, a key factor in determining if an asset is a security. It has also raised concerns that airdrops could be used to skirt around securities registration requirements.

“Given the SEC’s unwillingness to establish a regulatory framework in the United States, developers have been forced to block Americans from claiming ownership of a digital asset in an airdrop,” Emmer and McHenry said in the letter. “This includes individuals who may have been building on the network or otherwise contributing to its development.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The headquarters of the Securities and Exchange Commission in Washington, D.C., on Jan. 28, 2021. (Saul Loeb/AFP via / Getty Images)

Proponents of airdrops, like Emmer and McHenry, say because users are not investing money in the tokens – they are merely receiving them for free – it does not satisfy the “investment” prong of Howey. It also may not satisfy the “common enterprise” prong if receivers of the token are merely using them for utility purposes and do not expect to glean profits based on the efforts of the developers.

The lawmakers go on to suggest that by prohibiting Americans from participating in airdrops, the agency is preventing them from fully realizing the benefits of blockchain technology.

“Given the SEC’s approach during your time as Chair, the SEC has only ensured that the next iteration of the internet is not designed by Americans or with American values, which is not to the benefit of our constituents,” Emmer and McHenry concluded the letter, giving a two-week deadline for Gensler to respond.